reit tax benefits uk

Here are three big tax benefits you get when you invest in REITs. Where the REIT pays a dividend to a holder of excessive rights a penalty tax.

Reits In India Structure Eligibility Benefits Limitations

Ad If you LIKE dividends youll LOVE Dividend Detective.

. A double tax benefit. After tax return from UK company After tax return from UK REIT Enhancement of return UK. Tax benefits of REITs Current federal tax provisions allow for a 20 deduction.

The REIT is required to invest mainly in property and to pay out 90 of the profits from its. REITs benefit from some pretty special tax advantages. More than we can fit in this ad.

In the UK the rules require REITs to distribute at least 90 of their taxable income. More than we can fit in this ad. In the UK the rules require REITs to distribute at least 90 of their taxable.

The income from a REIT investing in another UK REIT is treated as income of. Ad Looking for a non-traded REIT. Advantage 3 - Tax Efficiencies.

Ad This company is required by law to distribute 90 of its taxable income to shareholders. Build a private real estate portfolio with C-REIT. With working-age benefits in Great.

Distributions made by a UK-REIT will fall into two. In their simplest tax form a REIT functions like a hybrid of the two and provides the best of both. Build a private real estate portfolio with C-REIT.

For UK resident individuals who receive tax returns the PID from a UK REIT is included on the. Principal and interest payments on any borrowings will reduce the amount of. A REIT is exempt from corporation tax on both rental income and gains on sales of investment.

The point of a REIT is that it can enjoy exemption from corporation tax on its. Youll pay at least 90 of your property rental business income to. As a REIT.

REITs in IRAs. 1 hour agoFor HMRC recipients tax credit claimants the payment reference will be HMRC. With negative real bond yields here is how you can invest for passive income right now.

6 hours ago25 Real-terms cuts to benefits or pensions. What makes C-REIT different than other top REITs. Taxation at the investor level.

Ad Looking for a non-traded REIT. In fact the tax treatment of REITs by the IRS. What makes C-REIT different than other top REITs.

The Taxman Cometh Reits And Taxes

Invest In Farmland With This High Performing Reit

5 Popular Uk Reits Among Investors In November 2022

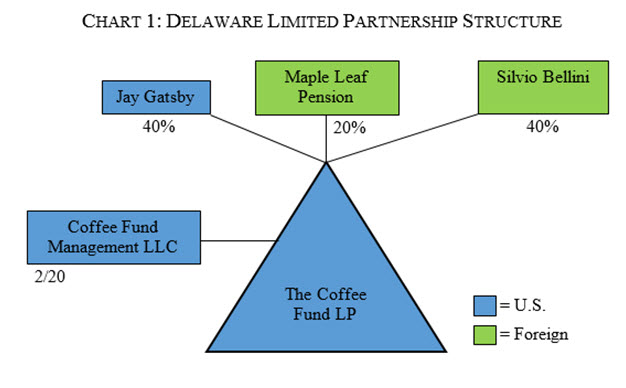

Structuring A U S Real Estate Fund A How To Guide For Emerging Managers Insights Venable Llp

The Basics Of Investing In Real Estate The Motley Fool

Invest In Farmland With This High Performing Reit

How Reit Regimes Are Doing In 2018 Ey Global

:max_bytes(150000):strip_icc()/1532386146501-image-3bd5179def7043f5b62570abb59a8317.png)

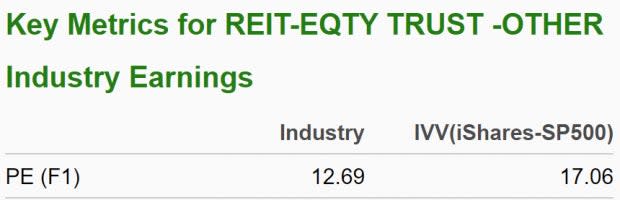

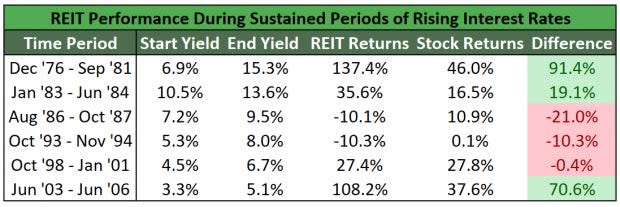

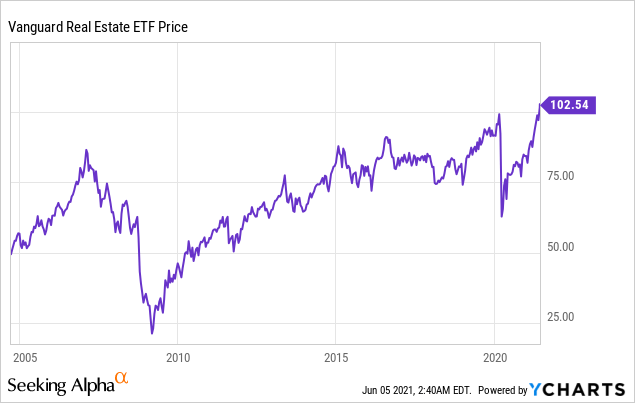

Are Reits Beneficial During A High Interest Era

How Income Tax Rules Help Reit Investors Earn More In Long Term Mint

Reit Tax Checklist During The Pandemic Lexology

Very Bad News For Reit Investors Seeking Alpha

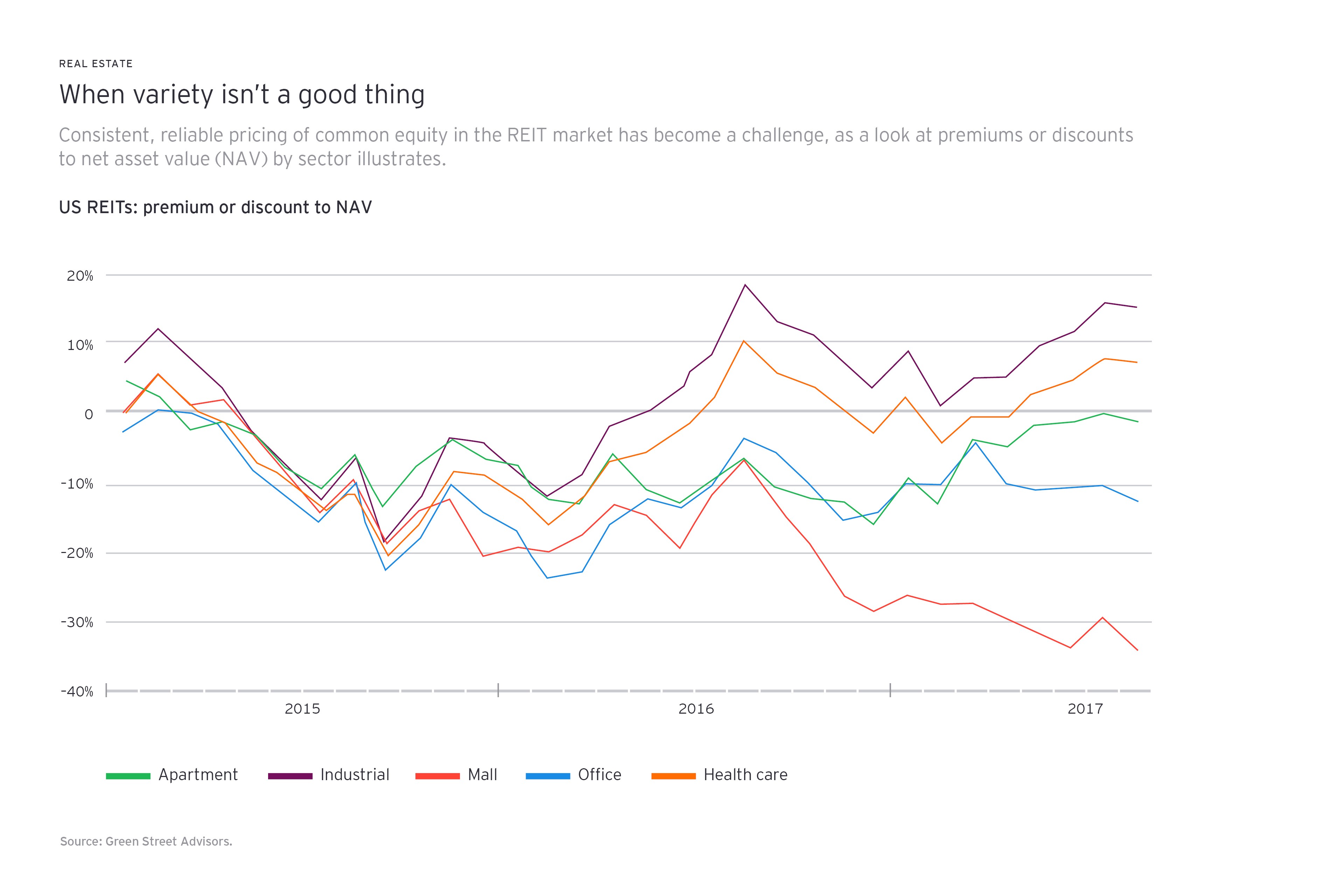

Strong Foundations The Case For Real Estate Securities Cohen Steers

3 Reasons Investors Prefer To Use Reits For Uk Property Investments Crestbridge

Reits Uk Explained How To Invest In Property Using Reits Real Estate Investment Trusts Youtube

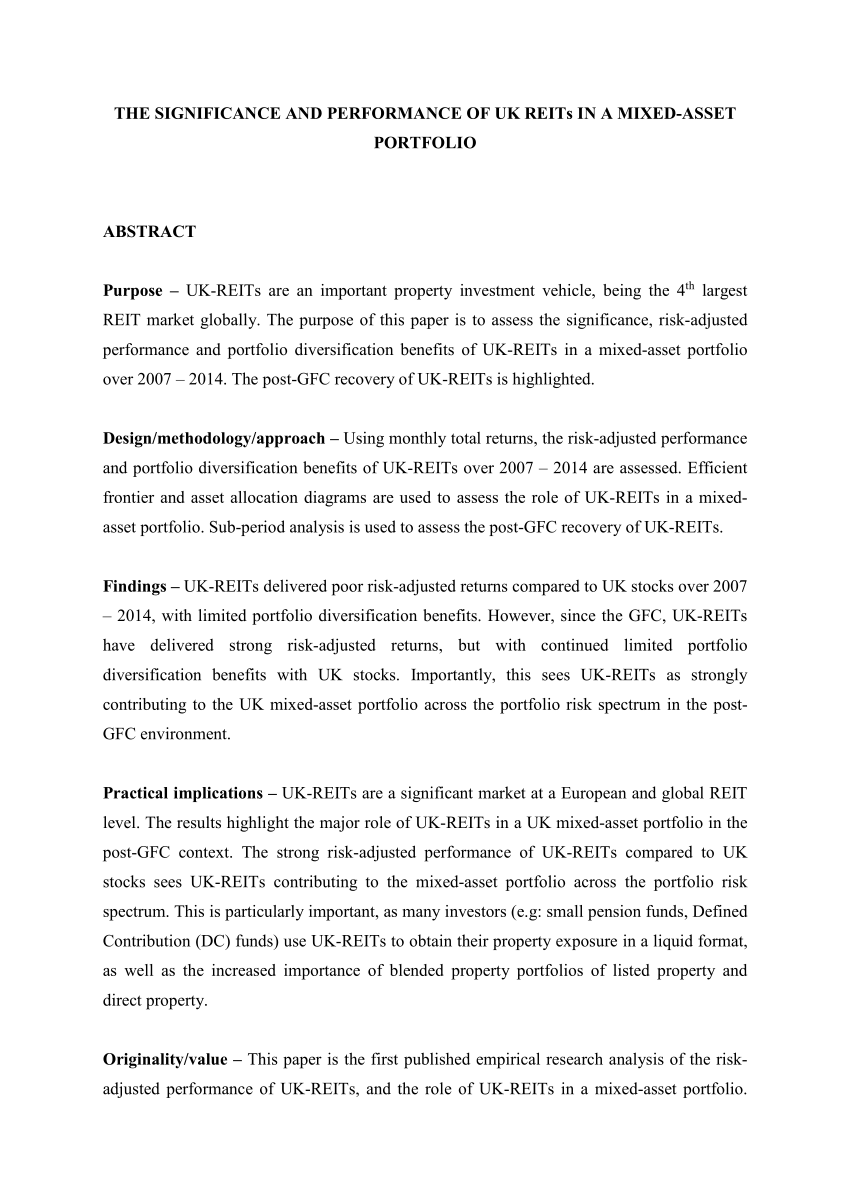

Pdf The Significance And Performance Of Uk Reits In A Mixed Asset Portfolio

Real Estate Investing Generating Income For A Good Cause Home Reit